Hot off the heels of our 2022 State of B2B Content Consumption and Demand Report for Marketers being named the Finny Award winner in the Best Research-Based Content category, we’re ecstatic to announce the 7th edition has been released.

Introducing the 2023 State of B2B Content Consumption and Demand Report for Marketers

If there’s one takeaway to glean from our 2023 State of B2B Content Consumption and Demand Report for Marketers, let it be this:

B2B content consumption continues to surge.

All told, we analyzed more than 5.4 million first-party registrations—an 18.8% increase YOY.

NetLine’s research unearthed dozens of incredible insights into the behaviors of B2B buyers.

Here are a few key highlights from this volume:

- Professionals registering for Webinars are 43.5% more likely to be correlated with a purchase decision <6 months.

- Consumption within the Computer/Technology industry—the largest segment in NetLine’s platform—increased 13.2% YOY.

- eBooks represented 33.6% of total registrations and were 3.5x more likely to be downloaded in 2022 compared to White Papers—yet Marketers produced 30% more White Papers than eBooks.

- 18.8% of B2B professionals expect to invest within the next 6 months.

This last bullet on buyer-level intent data is where we’ll pick up in just a moment.

First, let’s talk about the B2B consumption “big picture.”

Total Demand Has Risen 54.8% Since 2019

Yes, that’s right. Since 2019, total request volume is up just shy of 55%. That’s wild.

There’s no way to avoid the outsized influence COVID had on these figures and its ripples moving forward. The pandemic ushered in an even greater reliance on digital materials, formats, and marketing vehicles to allow businesses to connect with their audiences. (This case study featuring our client Mercer US Health is a perfect example of this.)

Now, onto the good stuff.

More than One-Third of B2B Buyers Are Investing Within the Next 12 Months

Businesses want to know when their prospects are likely to buy. As our President, Werner Mansfeld likes to say, the timing element is often forgotten in the sales process. Considering how pertinent it is to any relationship, having little to no understanding of timing is less than ideal.

Backed by our substantial buyer-level intent insights, we found that despite the lack of stability in the economy, B2B buyers still find themselves more than willing to buy, as 33.4% of them expect to make purchase decisions within the next 12 months—a YOY increase of 8.8%.

Buyers are looking to invest in the more immediate future, too, as 18.8% of all respondents stated they were looking to make additional investments within the next six months, a 23.6% YOY improvement.

For years, we assumed that content consumption was directly connected to investment. The belief was the more your audience consumes, the closer they are to a purchase decision. Thanks to our 2022 Consumption Report, we confirmed this.

You don’t need the entire B2B market to buy from you. Aside from this being highly improbable, it’s simply not necessary. What we’ve found, however, is that buyers are ready, so long as you’re studying the right signals.

The Consumption Gap Shrunk 4.6 Hours—That’s Good

The Consumption Gap is one of NetLine’s most unique and impactful statistics found in each report. We define the Consumption Gap as the time between the moment content is requested and the moment it’s opened for consumption.

From the time COVID hit, the Consumption Gap began widening even further, eventually evolving from gap to canyon. B2B professionals were taking longer and longer to actually consume the information they’d requested.

(This is precisely why we recommend our clients and other B2B professionals chill for 48 hours before reaching out to a new content lead—simply because they probably haven’t consumed the content yet!)

However, we’re happy to report that for the first time in three years, The Consumption Gap has shrunk. As we explain both in the report and in today’s social posts, we provide a few theories as to why this may be the case.

The best theory we have is that, given the state of the economy and the need for improved efficiencies, B2B buyers and professionals are simply more motivated and eager to consume the assets they’ve requested.

The (Evolving) Relationship Between Buying Journey and Content Format

Marketers promoted 30% more White Papers than eBooks in 2022. However, eBooks were 3.5x more likely to be requested. On the surface, these figures don’t align. But remember what we learned from last year’s report: Popularity ≠ purchase intent.

Last year’s research revealed that White Paper registrations were a greater indication of a user being in the later stages of a purchasing decision.

White Papers, Survey Reports, On-Demand Webinars, and Live Webinars still find themselves in the More Likely category, while the same applies to Tips and Tricks Guides, Cheat Sheets, and Book Summaries on the Less Likely side.

Still, formats appearing in the More Likely category hold different weight. Identifying which formats hold a stronger, more immediate signal is key to better understanding the behaviors and intentions of your audience.

Immediacy of Buyer Intent by Format

Page 30: NetLine’s 2023 State of B2B Content Consumption and Demand Report for Marketers

| Content Formats More Likely

Associated with a Buying Decision in Under 3 Months |

Content Formats More Likely

Associated with a Buying Decision in 3 – 6 Months |

|---|---|

| Software | Special Report |

| Live Webinar | On-Demand Webinar |

| How-to Guide | Survey Report |

| Best Practices | Video |

| Kit | Playbook |

| Executive Brief | White Paper |

From these findings, four insights stood out from the rest, specifically that B2B professionals registering for…

- eBooks were 10.4% more likely

- Reports were 4.6% more likely

- On-Demand Webinars were 43.4% less likely

- Live Webinars were 25.4% more likely

…to state that they would invest within the next three months compared to respondents from 2021.

Notably, eBooks don’t appear on either side of the ledger above. Even with being 10.4% more likely to say they’d invest within the next three months YOY, eBook registrants found themselves in the middle of pack for both categories.

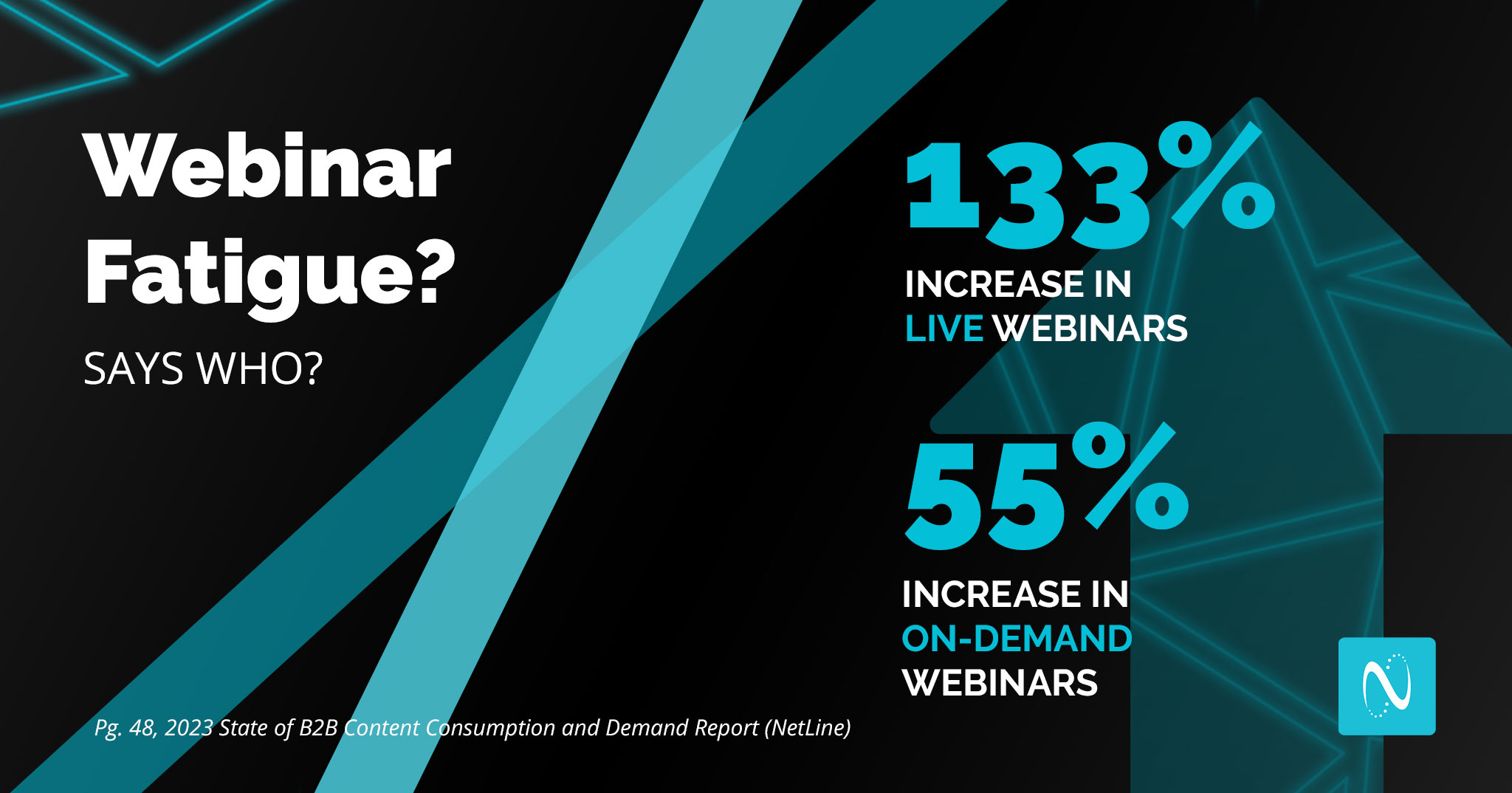

Webinar Fatigue Isn’t Real

Since the back half of 2020, we’ve heard the term, “Webinar Fatigue,” bandied about.

As marketers turned to #webinars to reach and serve their audiences during the COVID pandemic, NetLine saw a total 103% increase in webinar uploads. Similarly, between March and April 2020, ON24 reported a 333% spike in webinar attendance, with an increase of 251% in total demand YOY.

Once the in-person business resumed, it seemed likely that a natural slow down could occur. We kept waiting to see if and when B2B professionals would begin to reject webinars.

And waiting…and waiting…

Nearly three years later, we’re still waiting. We waited so long that Webinar registrations rose 81.2% in 2022.

It appears safe to say that Webinar Fatigue isn’t real.

Individually, On-Demand Webinar registrations increased 54.9% and Live Webinars grew a staggering 132.7%.

B2B marketers continue to clearly believe in Webinars, too, as organizations uploaded 39.3% more Webinars. On-Demand Webinars fell by 21.2% while Live Webinar uploads grew 58.1%.

Did we mention that Webinar registrations are a high-intent signal? It’s an important detail.

Just don’t expect them to drive significant volume. That’s a story for a different blog post.

Learn More About 2023 B2B Content Marketing Trends

Early returns from the data we’re tracking for our 2024 consumption report show that interest and demand from B2B professionals is only growing. As we enter into a new, AI-affected era, it’s vital to again reiterate the need to assess your marketing and how it aligns with real buyer behaviors.

We promise you that there are insights and stats within this report that will change how you market in 2023.

NetLine’s 2023 Content Consumption Report is now available for download. We hope you learn a thing or two.