This post was originally published on the Marketing Insider Group blog, our 4th in a series exploring B2B content consumption trends using Audience Explorer. With the holidays rapidly approaching, we wanted to share this piece with you so you could see just how diverse and fascinating the B2B retail industry truly is. Enjoy!

Black Friday. Cyber Monday. Giving Tuesday. These 3 days are some of the biggest dates on the entire retail calendar. This of course can mean only one thing: Holiday 2020 is here.

We don’t know how it will look but I, for one, am glad it’s here; we could all use the break. One group who won’t be getting a break, however, are those professionals working in the Retail field.

In the B2B world, retail professionals aren’t the ones on the Black Friday “front lines”, but they are competing for which products win primetime shelf space and ecommerce hero features. B2B retailers are working behind the scenes to get their products to market with the help of their consumer-facing partners. But in a year as rocky as 2020, thanks to the impact of COVID-19, what are B2B retailers doing to prepare themselves and their businesses for success?

Let’s unwrap this package together.

Analyzing the B2B Retail Audience

Seeing that it’s the Holiday season, we wanted to give you, dear marketer, something special.

This month’s edition contribution is a little different than the others, as Audience Explorer has gotten a bit of an upgrade!

Instead of only being able to break down audience consumption by Job Area, this update now allows you to analyze audiences by Industry, too. All of this real-time data is reflected in the tool and is ready to start slicing and dicing with you.

What’s on B2B Retailers Wish Lists for Holiday 2020

Before we can rip open the wrapping paper, we have to position it under the tree just so.

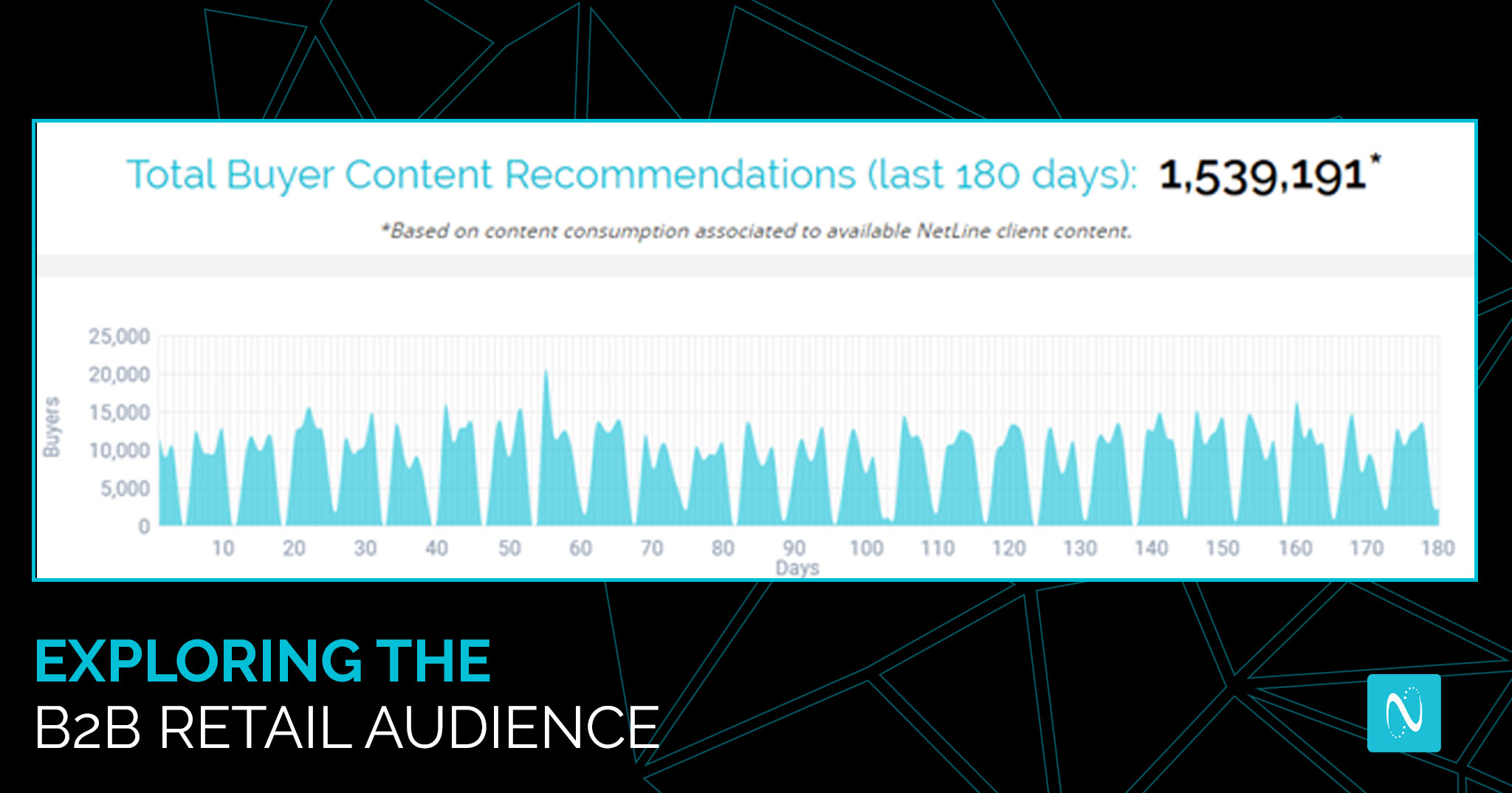

First, we’ll choose “Explore by Industry” from the buyer selection dropdown menu followed by “Retail and Consumer Goods”. When you arrive at the Report, select “United States” from the Region filter. By selecting the U.S. as our Region, this brings our total number of content recommendations from 1,748,324 to 1,539,191 over the last 180 days.

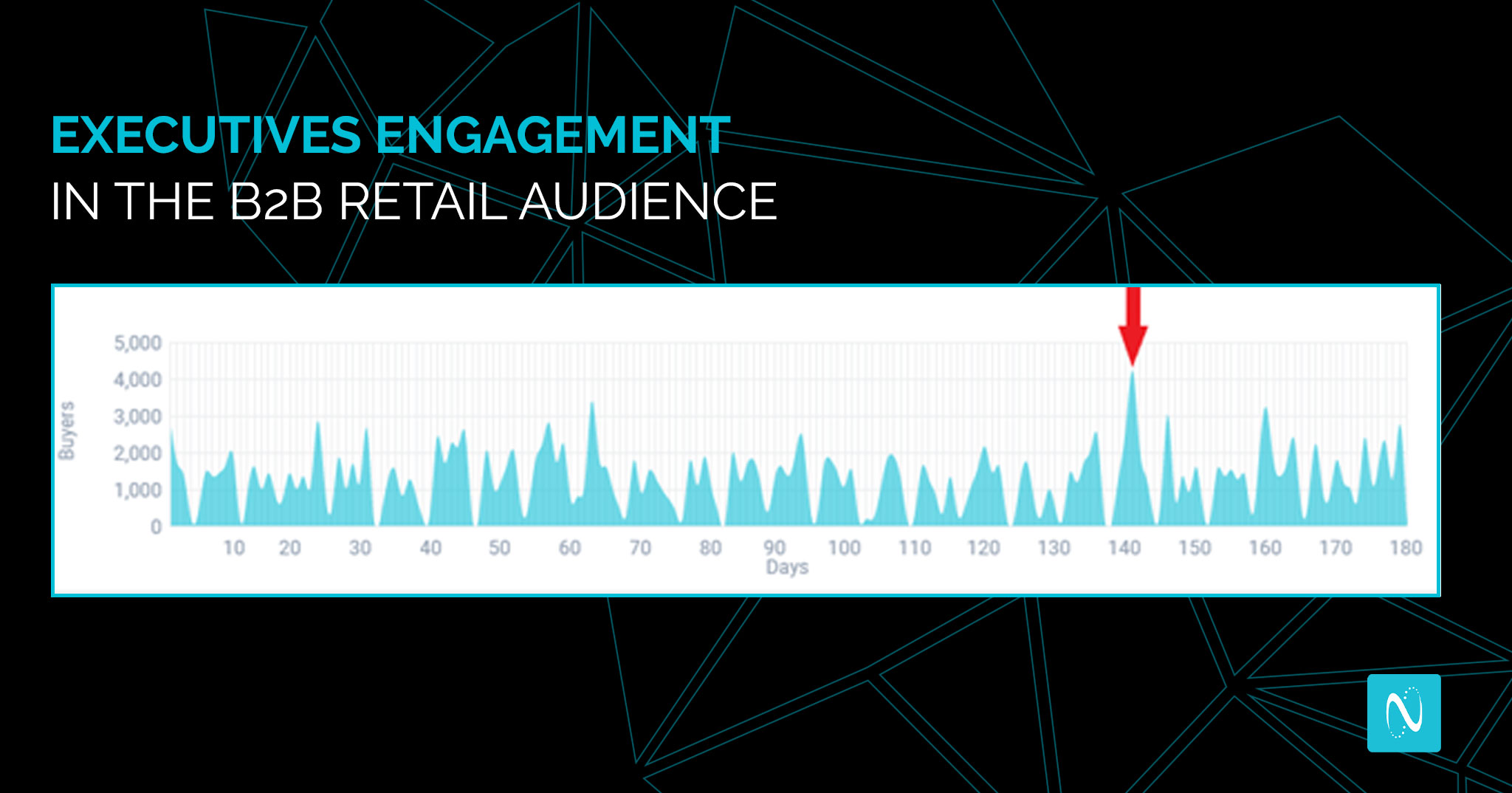

While those in the Retail Job Area audience generated a massive spike in overall consumption in mid-November (retailers seem to have a last-minute tendency just like their B2C buyers), the Industry as a whole has been quite stable.

OK, with everything set now we can open it!

What We Can Decipher From the Top Trending Topics

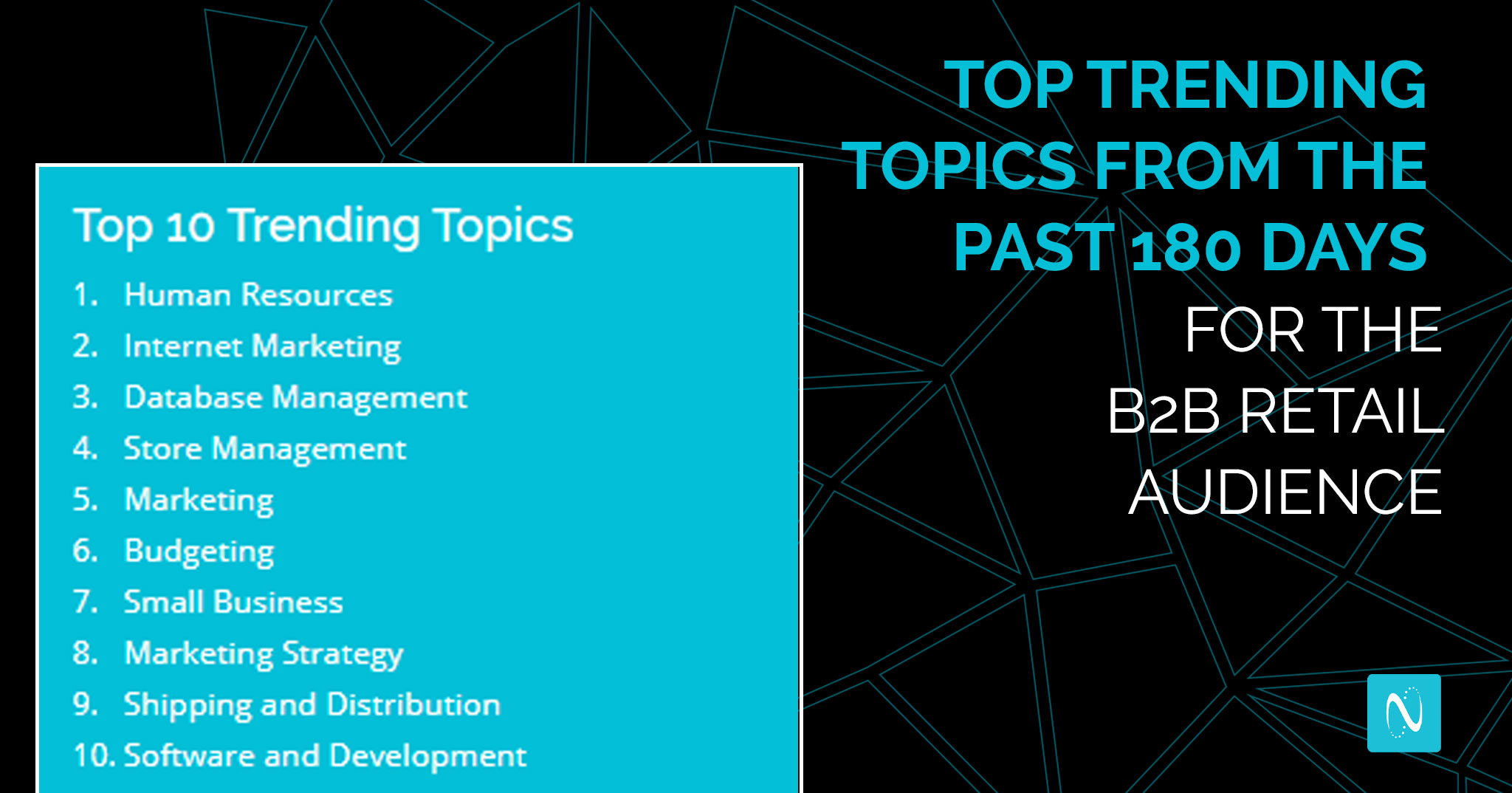

When we think about retail, I’d have to imagine that most of us think about physical locations. However, this isn’t an analysis of the B2C Retail audience, which is why Store Management is tucked neatly in the middle of the list at number 4. Despite the fact that our thoughts go immediately to our favorite retail locations, ecommerce will only account for 14.5% of total US retail sales this year. It’s a heavy reminder that while we may think that we do the bulk of our shopping online, the lion’s share still takes place in person.

But the rise in ecommerce sales, combined with the forecast for the next 5 years has forced retailers to take stock of their businesses beyond their inventory. According to research from emarketer, total retail sales will drop 10.5% in 2020, with ecommerce sales climbing 18.0%. This is why we see such significant interest in Internet Marketing, Database Management, Shipping and Distribution, and Software and Development.

Of course, we can’t ignore Human Resources at the top of the list. As we shared in 7 Trends B2B Marketers Should Keep Their Eye On, we noted the global interest there was in Human Resources, specifically at the Executive level.

Given the state of the world, leaders want to know what they need to make sure their employees are protected in every sense of the word. The other side of HR enables leaders to be sure that company assets are also protected, which lines up with some other trending topics for the Executive audience: Strategic Planning and Analysis (2), Accounting (3), and Budgeting (9).

Unsurprisingly, when we select the Executive Job Area filter, Human Resources remains at the top of the list.

Providing Context: An Expert’s Perspective

To gain a greater appreciation for what we’re seeing, we’ve once again invited an industry expert to help us assess the market’s consumption habits.

Dan Gingiss is a Customer Experience Expert, Speaker, and Coach with a deep background in the retail world as a Senior Executive, with stops at Discover and McDonald’s.

“What’s interesting about these trending topics,” he said, “is that I would imagine the list is fairly similar for B2C retailers. This makes sense, as B2B companies often forget that their customers are also consumers in their “real lives.” The reality is that every company — B2B and B2C — is being compared by the customer to the best experience they’ve had recently. B2B companies must consider customer experience as much as B2C companies. After all, they are not selling to a building or a nameless corporation, they are selling to a human being who is also a consumer.”

Regarding the consumption trends specifically, Gingiss made it clear how many of the Trending Topics were connected. “Virtually all of the topics being researched here have something in common: They are either directly or indirectly influencing the customer experience. Therefore, it is critical to ask the question with all of them: how will this affect the customer? Remembering that happy customers tell friends, colleagues, and social media followers, and that this word-of-mouth marketing is invaluable, companies must ask this question with every project, enhancement, or update.”

It could be argued that each of these Topics is associated with the need to become a Digital-First organization. As we’ve talked about before, many of the content consumption trends that we’ve analyzed this year have skewed towards digital development, specifically in the areas of software management and data infrastructure.

As Dan alluded to, enhancing these digital experiences is essential to the growth of business, especially in the retail space. While B2B retailers may not get the same immediate feedback that their B2C peers receive, they must still answer the calls to evolve with how buyers want to engage. With their focus squarely on things like Internet Marketing, Database Management, and Software and Development, clearly B2B retailers are looking towards the future with the customer experience in mind.

What the Buyer Stream Tells Us

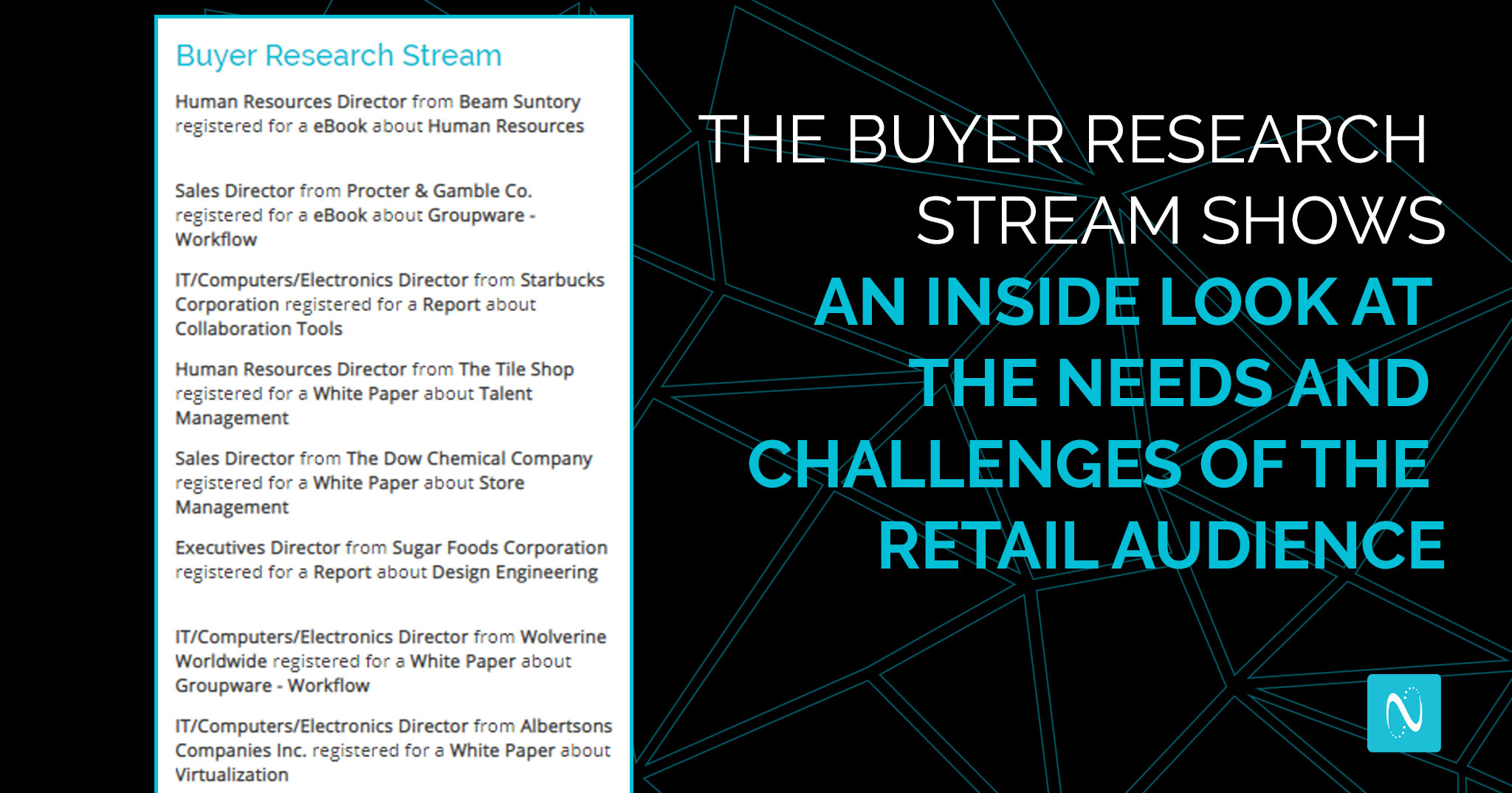

Two things stand out here. One is that in this snapshot of activity, every professional’s Job Level is at the Director level. The second is that Collaboration Tools are the main topic of interest (Groupware is also a collaborative tool).

What this tells us is that many retail employees are working from home and folks with direct reports and departmental responsibilities are doing what they can to educate themselves about the types of tools they need to be successful.

Come to think of it, there’s a third connection linking many of these buyers: Food. Beam Suntory, Starbucks, Sugar Foods, Albertsons, and P&G are all in the Food Production business. We’ll dive into their consumption habits further in the next section, as their behavior is a major player in this audience.

Slicing Up the Pie Charts

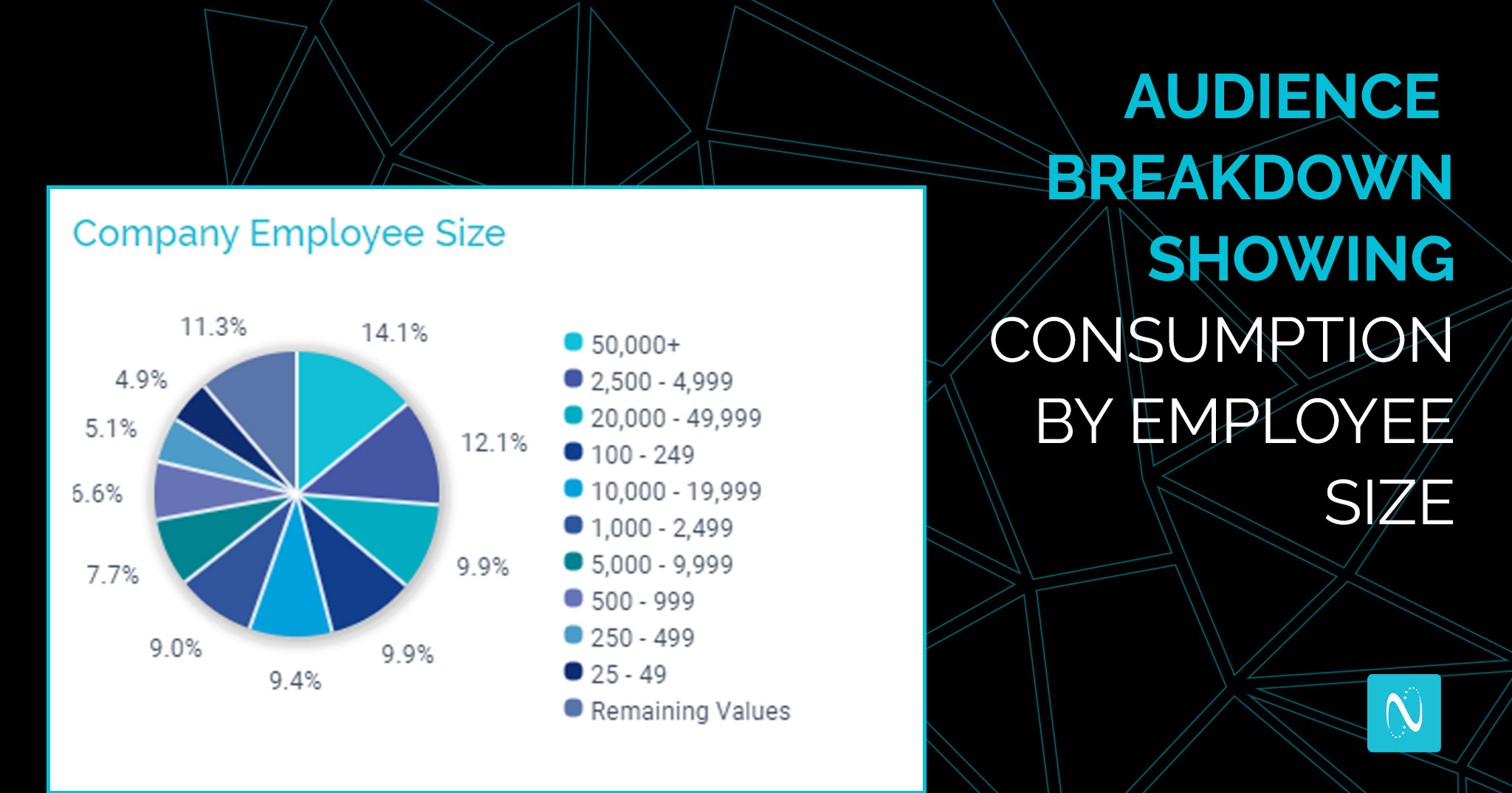

The most visual, and interactive, portion of Audience Explorer is the pie chart section. In the Industry section of the tool, content consumption data is broken down into 4 specific categories: Company Sub-Industry, Job Level, Job Area, and Company Employee Size.

Company Sub-Industry

The overwhelming majority of this audience came from the Retail and Consumer Goods industry (46.4% when you combine Retail and Consumer Goods with the Consumer Goods). It’s not surprising, so let’s dig further into this filter to see what else we can learn about their consumption habits of those in the Food Production category.

While healthcare workers deserve their own standing ovation for what they’ve had to endure during COVID, employees in the field of Food Production have had their work cut out for them, as well. Just as we see with the larger analysis, Human Resources is the number 1 topic for this filter, followed by Automation, Budgeting, Supply Chain, and Social Media. While HR is a huge subject for this space, topics 2-4 are all, likely, a direct response to how food must be handled at all points of its journey during the pandemic.

In its Responses to the Impact of COVID-19 on the U.S. Food Industry report from FTI Consulting, Inc., the company shares that Americans are more likely to “purchase processed and comfort foods for a sense of security and indulgence” and buy “frozen, center aisle, extended shelf life food”. Given that nearly 30% of the companies in the Food Production field employee 50,000 people or more, automation would certainly already play a vital role in their operations. But if U.S. consumers are expected to continue to eat like this, automation, supply chain, and shipping and distribution are all major factors in how they’ll continue to function.

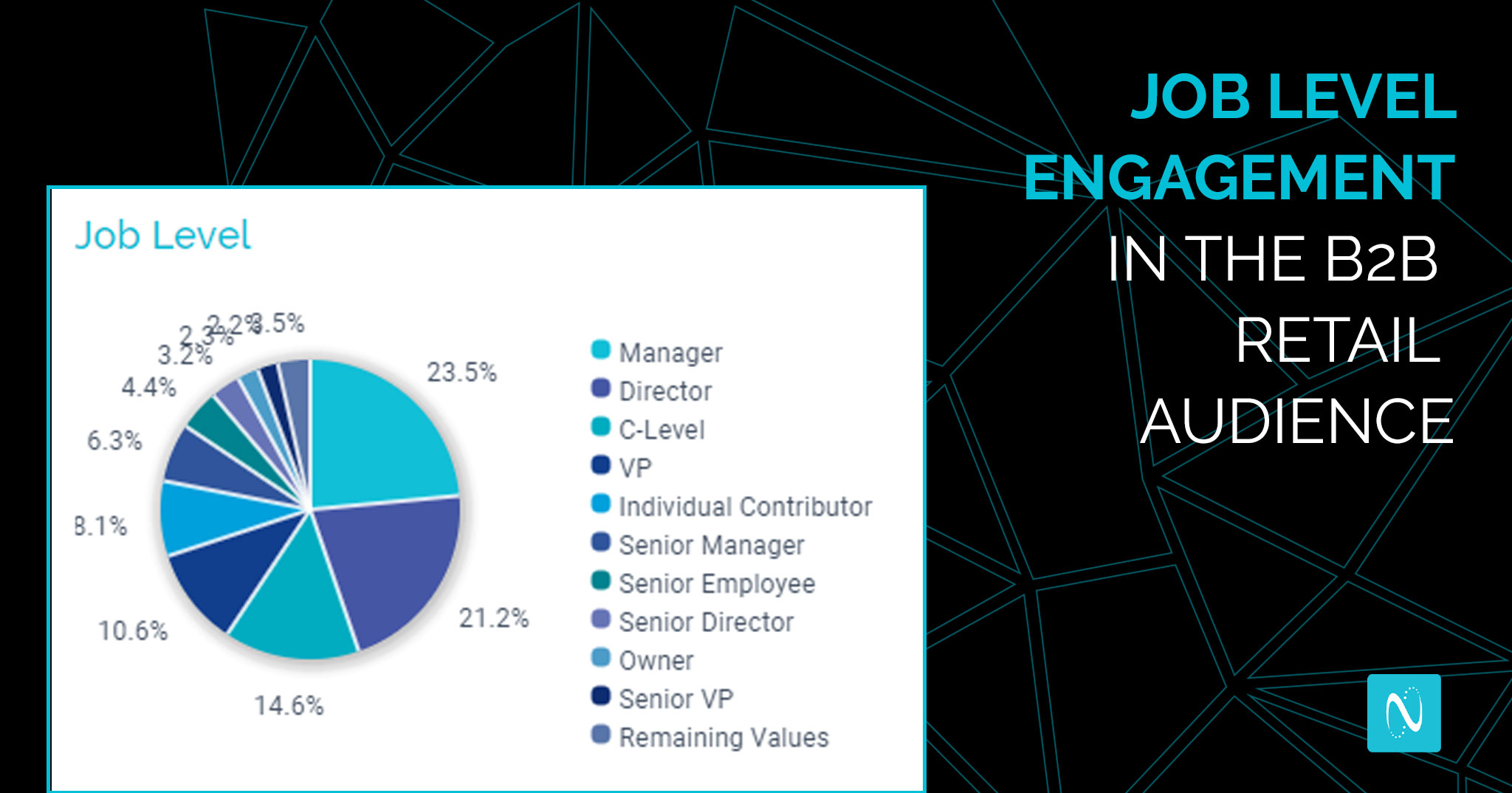

Job Level

Managers and Directors are the big content consumers in the B2B retail industry, with much of their interest focusing on Database Management, Decision-Making, and Budgeting.

The C-Suite was also quite interested in cost centers, requesting content related to Budgeting, Human Resources, and Shipping and Distribution. While the audience’s consumption demand has remained level throughout the last 180 days, the C-Level’s interest piqued roughly 40 days ago. Executives are always looking and thinking ahead, considering hundreds of different data points and how they’ll impact the business in the big picture.

Managers and Directors, meanwhile, are keeping tabs on what’s happening in the moment. Each group might be consuming the same types of content, but how and when they’re consuming it matters.

Company Employee Size

Despite the fact that the behemoths of the B2B retail world are the biggest players here (14.1%), this is one of the most evenly distributed pie charts I can remember seeing in Audience Explorer. What is unfortunate, but expected given how many hats they likely wear, is the ~5% of total consumption that companies with 25-49 employees accounted for. Unfortunate in this case isn’t meant to be a knock on their habits or their desires to better their businesses but rather their bandwidth to do so.

Let’s assume for a moment that Winter 2020 is going to be one of very limited activity. To withstand another prolonged stay-at-home order or sequester will involve addressing the rapidly-evolving needs of consumers. National brands have the resources to invest in robust digital programs that accommodate these changes in behavior. How can smaller retailers do that?

One way, certainly, is to continue to get scrappy with your marketing and keep learning about the technological opportunities there are at our fingertips. When your world turns upside down, you’re looking for every method of survival.

Job Area

While not as evenly divided, the Job Area chart shows us that there were roughly 6 groups most interested in Retail content: IT, Marketing, Executives, Finance/Accounting, HR, and Sales.

Retail pros in the IT/Computers/Electronics Job Area were most interested in learning more about Collaboration Tools, as were Marketers, while Finance/Accounting employees focused on Strategic Planning and Analysis. The one topic that connected each of these Job Areas? Human Resources, of course.

Which Type of Content is Requested Most?

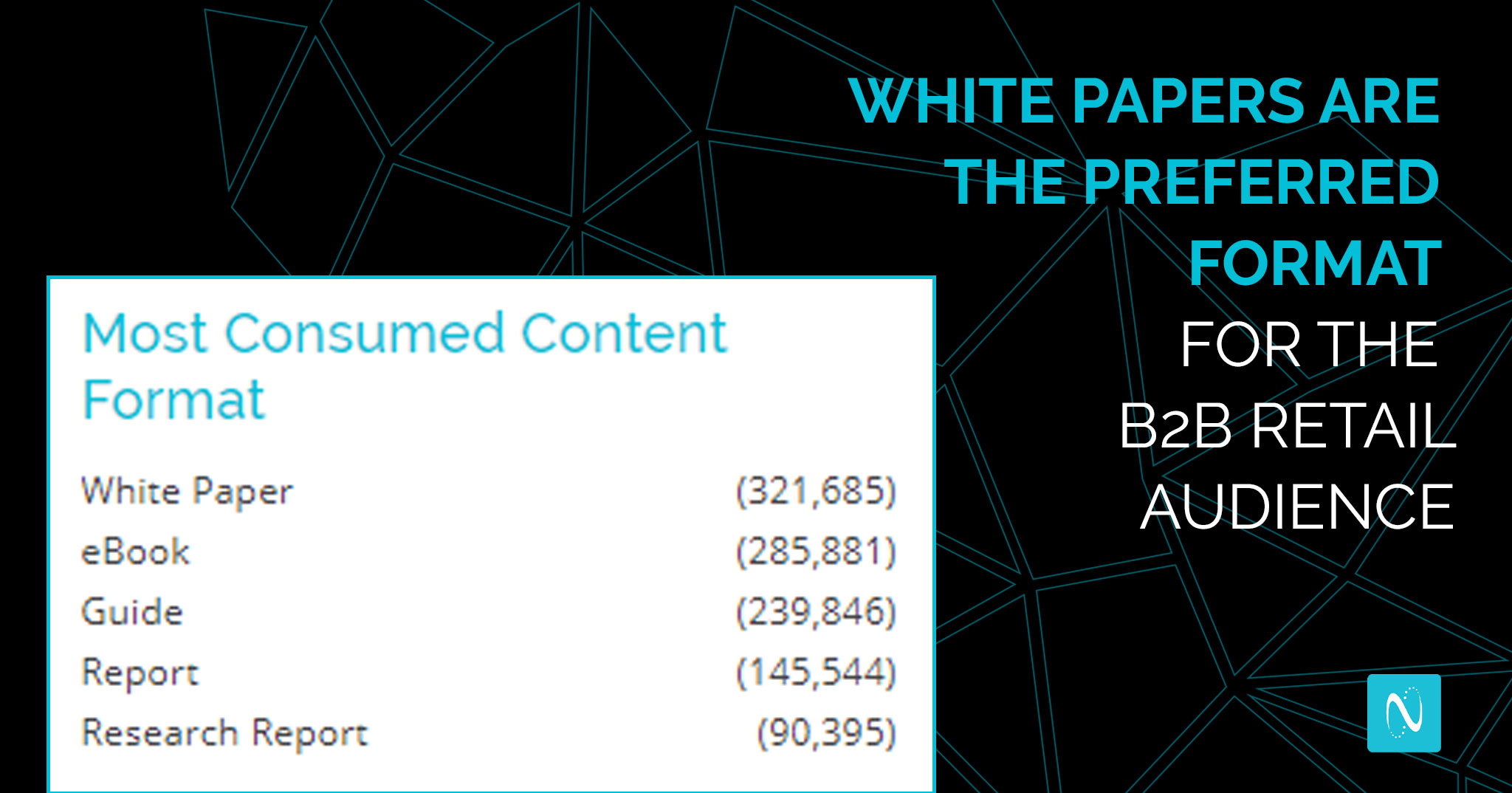

We’ve finally encountered another audience where eBooks aren’t the predominant content format. Perhaps we’ll have to dedicate an entire portion of our 2021 State of B2B Content Consumption and Demand Report for Marketers to the retail industry and their consumption behavior around White Papers. Yes, White Papers are the 2nd most consumed content format in general, (and tops in the Legal field, as well) but eBooks often hold such a dominant advantage that it’s just assumed eBooks will top the list.

From what we can observe, we believe that retail audiences were primarily interested in the rapidly-evolving trends of consumers. While most trend analyses are published in basic text containers like eBooks and Reports, White Papers are best for cutting straight to the facts, which is ideal for professionals looking to make the best data-backed decisions in a strange, unpredictable year.

Who’s Requesting Content?

When 33.4% of all content being consumed by this audience is from organizations with between 10,000-50,000+ employees, you’re not expecting your favorite local sports retailer to show up on this list. (And don’t worry, they don’t).

Anytime we’re talking about Retail sales, Walmart is going to be right around the top of every list. Amazon may have them in their sights, but when it comes to retail sales ($523.96B in 2019 according to the National Retail Federation), Walmart is still king. Despite direct rival Target outpacing their content consumption by just a hair, everyone in the world of retail always has Walmart on their mind.

Consumption of Another Kind

Beam Suntory (Food Production) lapped the field in overall consumption by a factor of 5. This re-emphasizes our point that retailers needed to stay on top of industry trends just to have a sense of what they needed to do to remain relevant in 2020, let alone competitive. While Beam is indeed in the Food Production space, it’s worth calling out what they really produce: Alcohol.

According to a study by the RAND Corporation, overall alcohol consumption increased by 14% YOY — the equivalent of one additional day of drinking per month — in Americans over the age of 30. This not only would account for a dramatic uptick in sales for Beam Suntory, which features names like Jim Beam, Maker’s Mark, Hornitos Tequila, and Pinnacle Vodka on its roster, but is a clear correlation between the Spirits industry and how people are coping with the realities of the pandemic. Knowing that the Holidays are approaching and our natural inclination to go a little heavy on the egg nog, we’d just like to encourage everyone to enjoy their beverage of choice responsibly.

Time to Wrap Up Another Year

Terrible gift-puns aside, 2020 has been one helluva year. B2B retailers have done a terrific job of adjusting on the fly and doing what they can to make the retail experience simpler for their target customers.

We’re going to learn a lot about how much the retail economy has changed YOY from 2019 in the coming weeks. It’s entirely possible that 2021 will cause even bigger shifts in this audience, forcing them to adapt once again. Although we’ll see you again in December, NetLine would like to wish you all a happy and, perhaps most importantly, a healthy holiday season!

Special thanks to Dan Gingiss for providing his expertise and insight to this article. You can learn more about Dan and his work at his website, listen to his awesome podcast Experience This!, and find his book Winning at Social Customer Care: How Top Brands Create Engaging Experiences on Social Media on Amazon.