The sun is setting at 4:45 PM (for now), and Vince Guaraldi season is fully upon us.

This can only mean one thing: B2B marketing is over for 2025!

I’m kidding, of course. (Seriously, don’t stop your marketing efforts.)

B2B marketers love a good excuse to go dark in December. I can think of three excuses off the top of my head:

-

- “We don’t want to waste money.”

- “Everyone is getting ready to check out for the Holidays mentally.”

- “No one is engaging with serious content this time of year; they’ve moved on to 2026.”

If you’re not careful, Q4 can feel like the Bermuda Triangle of buyer attention. But as we shared this time last year, our data says otherwise.

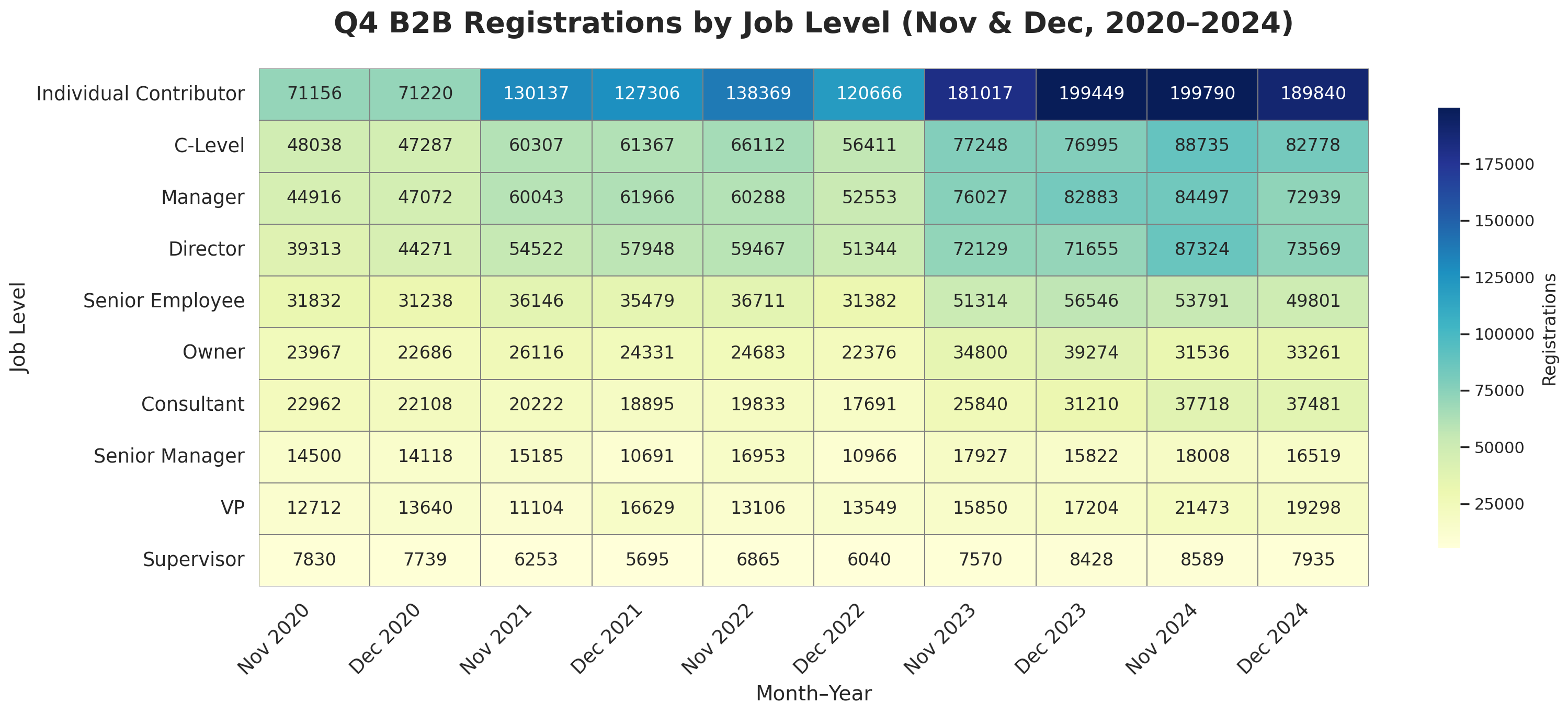

Q4 Consumption Has Risen 67% Since 2020

This article highlights how professionals are engaging with AI content across the NetLine platform, which topics resonate most, and how marketers can navigate this wave with confidence and clarity.

For five years running, the fourth quarter hasn’t experienced a slowdown in the slightest. In fact, the people who matter most in B2B are consuming a significant amount of Q4 content: decision-makers.

Since 2020, the overall increase in Q4 content consumption across these 10 Job Levels has risen 67.1%.

If your team is still treating December like a marketing dead zone, you’re not just missing the moment; you’re leaving high-intent, late-stage demand on the table.

Job Level Ups and Downs

Every Job Level has seen its content demand increase since 2020. That’s no surprise, considering that total consumption grew 83% during this same timeframe. Also qualifying for the no surprise category are Individual Contributors, with a Combined Growth of 173.7%.

Now, let’s get into the good stuff.

| Job Level | Combined Growth |

| Individual Contributor | 173.7% |

| Director | 92.5% |

| C-Level | 79.9% |

| Manager | 71.2% |

| Consultant | 66.8% |

| Senior Employee | 64.2% |

| VP | 54.7% |

| Owner | 38.9% |

| Senior Manager | 20.6% |

| Supervisor | 6.1% |

-

- Directors, C-Level, and Managers all saw Combined Growth well above 70%, with Directors requesting 92.5% more content in 2024 than in 2020.

- Supervisor consumption plateaued, if not decreased, relative to the growth of other Job Levels.

- Consultants and Owners were the only Job Levels to consume more in December than in November.

- Directors and Managers saw significant decreases from November to December, lending to the idea that these Job Levels conclude the majority of their research prior to the end of the year.

| Rank | Job Level | Nov Growth | Job Level | Dec Growth |

| 1 | Individual Contributor | 180.8% | Individual Contributor | 166.6% |

| 2 | Director | 122.1% | C-Level | 75.1% |

| 3 | Manager | 88.1% | Consultant | 69.5% |

| 4 | C-Level | 84.7% | Director | 66.2% |

| 5 | Senior Employee | 69.0% | Senior Employee | 59.4% |

| 6 | VP | 68.9% | Manager | 55.0% |

| 7 | Consultant | 64.3% | Owner | 46.6% |

| 8 | Owner | 31.6% | VP | 41.5% |

| 9 | Senior Manager | 24.2% | Senior Manager | 17.0% |

| 10 | Supervisor | 9.7% | Supervisor | 2.5% |

December is a Decision-Maker Month

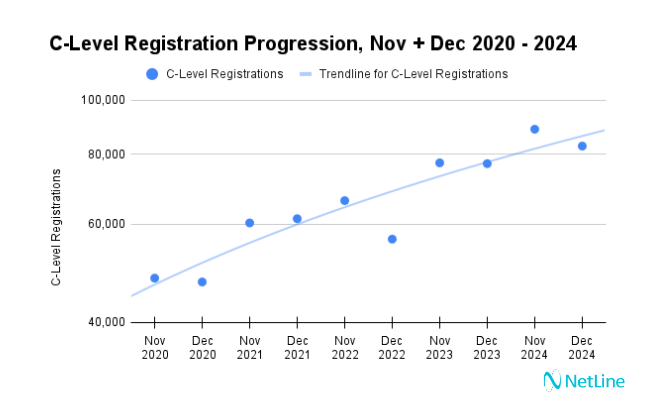

While no one would have blamed you for wanting to write off November and December 2020, it was during this time period that C-Level engagement began to swell.

In the five years since, C-Suite consumption has grown 85% in November and 71% in December, respectively. Combined, that’s an 80% increase.

Compared to other professional buyers, C-Level professionals (minus Individual Contributors) consistently lead all other roles in average content request volume:

-

- In November 2024, C-Level professionals were 107% more likely to request content than the average of all other job levels (Manager through Supervisor).

- In December 2024, this likelihood grew even further, with C-Level professionals being 113% more likely to request content than the average of all other job levels.

The C-Suite, rightly or wrongly, is the crown jewel of B2B campaign targeting. Considering this fact and the data provided here, all of this should be music to your ears.

Doubling Down on Decision-ber

While everyone wants to reach the executives, your next-best prospects might be sitting just one rung below. And they’ve been heating up year after year.

Director-level registrations in November jumped 122% from 2020 to 2024, while December rose 66%.

While November is the better month to reach Directors, these aren’t casual browsers looking for fluffy content to fill the gaps between PTO days. These are mid- to senior-level decision-makers actively planning, approving, and investing as the year winds down.

VPs saw strong momentum in both months, with December engagement increasing consistently for four years straight before a minor dip in 2024.

These positions are often the first lieutenants of the C-Suite, and while their consumption patterns are historically less predictable, these are the players evaluating tools, setting team agendas, and building plans for next year. The ideal audience for strategic content, late-funnel offers, and gated assets built for buy-in.

Finally, while Owners are not seen as a role charged with leading an enterprise-sized business, these SMB proprietors are acting similarly to their CEO peers.

Timing is Everything — And It’s Role-Based

When we broke the data down by job level and month, a clear pattern emerged.

Use the chart below to take steps for your December campaigns.

| Role | November Behavior | December Behavior | Takeaway |

| C-Level | High & rising | Still strong (slight dip) | Plan big bets for early December |

| VPs | Steady rise | Often peaked in December | Prime audience for late Q4 campaigns |

| Directors | The apex | Definite decline | Front-load content in early Q4 |

| Managers & ICs | Peak in Oct–Nov | Sharp drop in Dec | Wrap campaigns for them by Thanksgiving |

Don’t Get Caught Flatfooted

If you’re waiting until January to re-engage your buying committees, you’re already behind.

The data from 2020–2024 proves that December (Decision-ber!) is a decision-maker month. These aren’t prospects on autopilot — they’re leaders with deadlines, budgets, and a clear mandate to move.

The holiday hustle is real, so keep your foot on the gas.

And the opportunity is right in front of you.