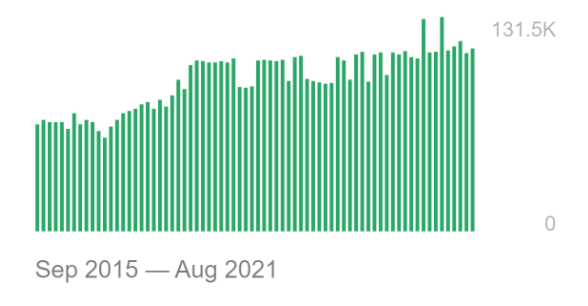

Artificial Intelligence is one of the most talked-about topics in the world of technology. One search for “artificial intelligence” on Twitter and you’ll be introduced to articles on how AI is shaping the future of healthcare, productivity, art, and food. Beyond the Twittersphere, searches for the term AI have doubled over the past six years according to data from Ahrefs.

All of this digital activity must mean that everyone is ready to adopt AI into how we manage and operate our businesses, right? Right?

what most describe as “artificial intelligence” is really just an if statement

— excelhumor.xlsx (@ExcelHumor) October 25, 2021

It’s well worth noting that while AI is poised to augment our future in a big way, there is still a lot of work to be done. Many companies use AI as nothing more than a Marketing message; a siren, knowing that for some people the allure of artificial intelligence outweighs its actual output, allowing them to get away with empty promises.

For as many good jokes as this opens the door for, there are still many companies fully capable of providing high-quality AI software. Of course, all of this leads us to a natural question: When will everyday businesses and professionals use AI software to enhance their work?

Fortunately, this is something that NetLine has greater visibility into.

The Challenge

- Better understand the AI software market beyond its current buyers, especially the big names like Apple, Amazon, and major car manufacturers.

- What kind of obstacles stand in the way of AI software solutions providers further permeating the market?

The Goal

- Identify and understand how leading IT decision-makers use or intend to use AI software and whether they intend to increase their investment any further within the next 12 months and beyond.

- Such observations should exclusively be captured via first-party interactions with IT buyers as they voluntarily registered and consumed related content.

How This Data Was Captured

By tapping into dramatic scale beyond the limitations of their own content, our customer leveraged NetLine’s Intent Discovery product to secure first-party sourced intent-rich data squarely aimed at accelerating sales outcomes. Empowered by NetLine’s entire universe of content, the client put to good use all 13,000+ assets, billions of data points, and the 35,925,120 different ways of filtering buyers actively performing research.

Unlike traditional intent data, Buyer-Level Intent Discovery helps you better understand the challenges, priorities, and purchase timeline of your ideal targets. Nothing is hidden behind obfuscated datasets and/or black box proprietary scores.

Perhaps most importantly, Intent Discovery acts as an always-on monitor of all B2B content consumption behavior as professionals are actively researching content specific to their challenges. Monitoring activity is then mined on a real-time basis and intercepted once a buyer has met or exceeded each element required to define intent—capturing custom, intent-rich, customer-specific insights directly from the prospect.

The Questions

To answer the questions, we engaged nearly 2,000 senior-level IT decision-makers to assess their desire to invest in AI software and what their priorities are with this technology.

Here’s a sampling of some of the insights we uncovered from their responses.

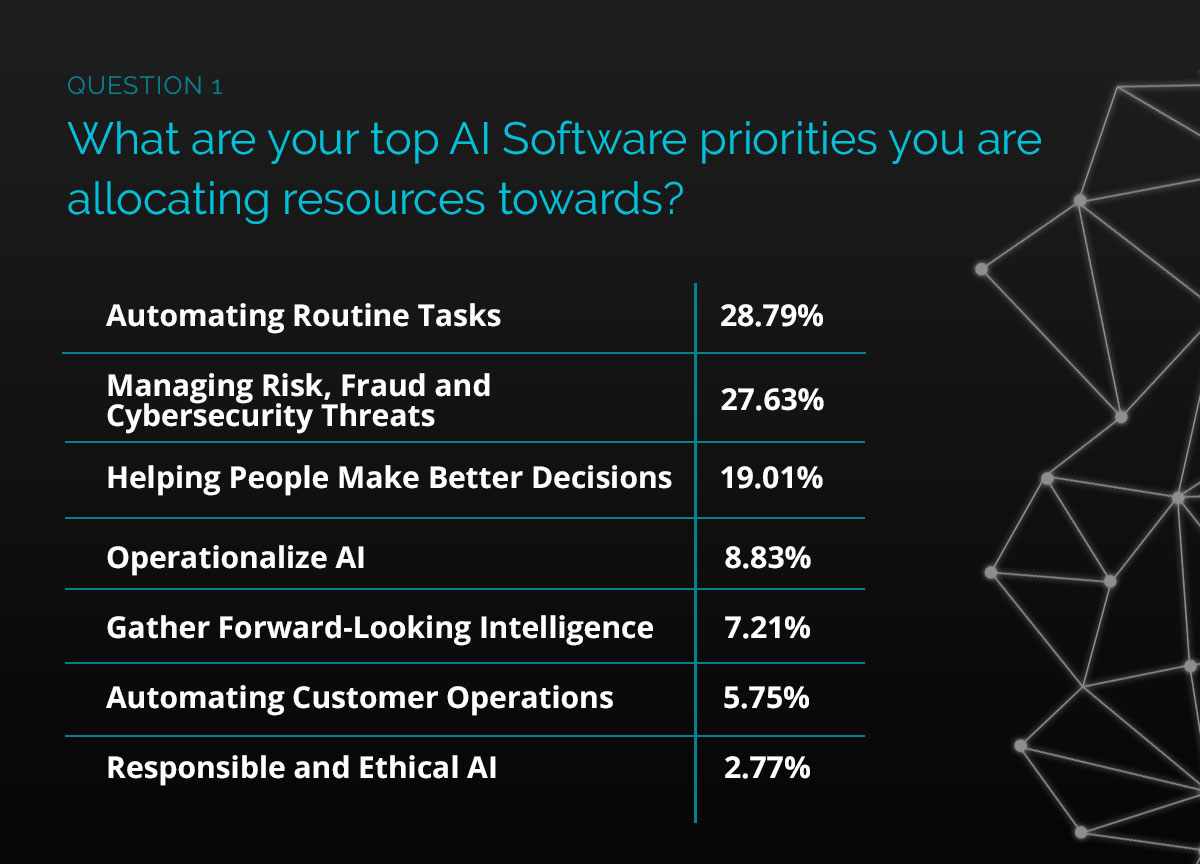

What are Your Top AI Software Priorities You Are Allocating Resources Towards?

Perhaps the best way to summarize the needs of B2B professionals when it comes to how they’d like to deploy AI software comes down to two things: The mundane and the complex.

As you can see in the responses above, this is what the data tells us; if AI software can knock out the simple, monotonous tasks people spend a large portion of their time (which it can), while also supporting some pie-in-the-sky type analysis, (yep) then there’s a market just waiting to be tapped.

Of course, if it were that easy, we’d already see a wider-permeation of the market. What other challenges face this market? More on that in the next section.

Some of the other notable insights include the following:

- Automating Routine Tasks (28.79%) and Managing risk, fraud, and cybersecurity threats (27.63%) drew the most votes from all respondents.

- Incredibly, only 2.7% of all respondents prioritized the responsible and ethical use of AI—meaning that nearly two-thirds (61.9%) of all responding industries didn’t even consider this option a priority. Given what AI can do in the wrong hands or when left unsupervised, the apparent lack of concern in regards to ethics is shocking.

- The Healthcare/Medical industry was 124.4% more likely to say Automating Routine Tasks with AI was more important to their profession compared to the Telecommunications field

- 14.57% of Finance industry respondents said that Operationalizing AI was the top priority they had with any AI software, the largest percentage of any industry for this priority

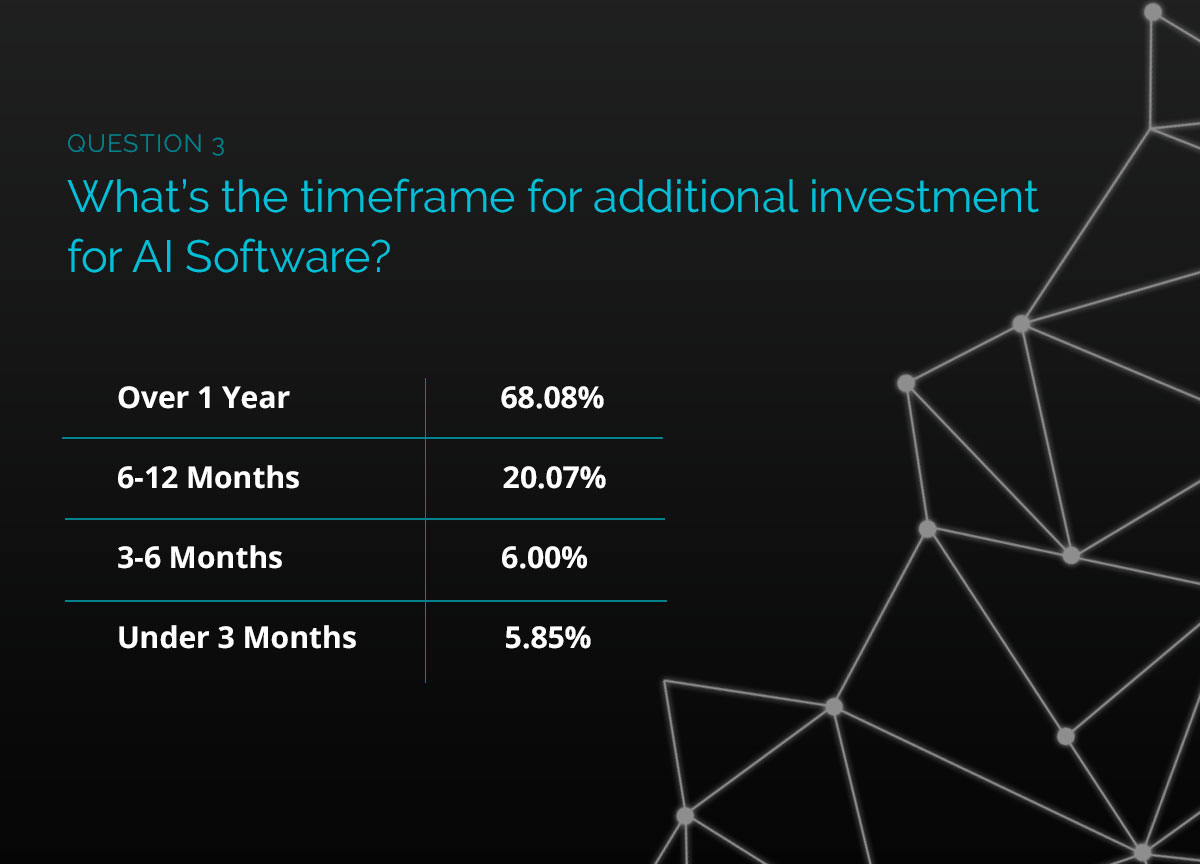

What’s the Timeframe for Additional Investment for AI Software?

It’s one thing to talk about AI in theory and how you might use it. It’s an entirely different, and ultimately more compelling, thing to see when and even if you’ll put your money where your mouth is.

As we mentioned in the intro, AI has primarily been a luxury employed by large companies thanks to its price tag. According to Analytics Insight, AI tools can cost anywhere from $20,000 to $1 million dollars, essentially putting it out of range for any business not employing thousands of people. Even with this knowledge, the responses paint a much more encouraging picture of what future implementation might look like.

Let’s find out where the market current sits:

31.92% of all respondents have an AI-related investment event occurring within the next 12 months.

- 5.85% of respondents said they were looking to make an additional investment within the next 3 months, meaning that respondents were 1034.45% more likely to say they were more inclined to wait Over 1 year to invest compared to Under 3 months.

- Respondents were 213% more likely to say that any additional AI investment would come after 2022 (beyond 12 months)

While a third of the market is preparing to make additional, if not initial, forays into the world of AI software in the coming year, the remaining two-thirds are biding their time. There are a number of ways to interpret this, including not having the potential budget, not having the staff or business to support it, or perhaps they’re simply not ready to take on the commitment of what AI entails.

With how strange 2020 was with the way 2021 has unfolded, it’s not terribly surprising that professionals are looking to defer until 2022 at the earliest. Still, if there’s one thing AI vendors should take from this Intent Discovery Trends Report, it’s that nearly 6% of a $62 billion market is ready to make a move in the next quarter.

The Results

For businesses in the AI software space or even for those flirting with the idea of adding AI to your arsenal, you now have a superior and more accurate understanding of where your potential clients/peers are in their unique buying journey.

For example, through Intent Discovery, we found that:

- 100% of Utility/Energy respondents said that Managing risk, fraud and cybersecurity threats was their sole priority when it comes to AI software utilization.

- Compared to their peers, the Automotive field looks to be quite bullish on AI software, with 11.11% of their employees saying they expected additional investment to be made within the next 6 months or less—with an additional 25.93% believing that moves will be made within 12 months.

- Professionals within the Transportation industry are 754% more likely to be making an AI investment decision in under three months vs. their peers across other industries, there’s a clear trend across the world of travel that AI software businesses need to be aware of.

Buyer-Level Intent Discovery removes the guesswork that comes with every lead and instead provides context to what each prospect needs and what your buying audience craves. Insights like these are more valuable than gold, as they set the table for more productive and more fruitful interactions, relationships, and, hopefully, sales.

How Your Business Can Better Understand the Intent of Your Audience

In today’s hyper-competitive vendor market, it is more important than ever to understand the real-time pain points and in-market tendencies of your future buyers.

NetLine’s Intent Discovery product helps businesses accelerate its sales cycle by capturing first-party intent data by intercepting and engaging the buyer with customized validation questions. With this one-of-a-kind product, B2B Marketers can gain first-party insights for immediate activation and seamless remarketing/sales acceleration.

For more information on how you can move beyond account-level insights and start your buyer-level intent discovery journey, contact us, or visit our website.