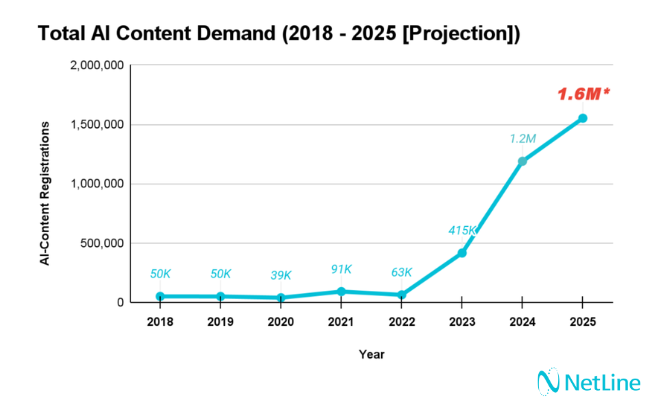

AI-related content continues to command serious attention across NetLine’s platform.

Through October 24, 2025, AI-related registrations surpassed 1.26 million—meaning that this year’s registrations have surpassed 2024’s by 6.1%. And that demand is being met with a matching supply of fresh content tailored to help professionals keep pace with the evolving technology landscape.

This article highlights how professionals are engaging with AI content across the NetLine platform, which topics resonate most, and how marketers can navigate this wave with confidence and clarity.

Job-Level Trends: Decision-Makers Move In

One of the most striking trends from 2025 is that engagement from senior job levels is increasing, while interest from individual contributors is declining.

It’s striking because each time we have published our annual State of B2B Content Consumption and Demand Report, registrations from individual contributors have only ever increased.

| Job Level | 2024 Registrations | 2025 Registrations | YOY Delta |

| Individual Contributor | 390,439 | 379,948 | -3% |

| C-Level | 153,232 | 176,411 | +15% |

| Director | 122,864 | 155,003 | +26% |

| Manager | 130,235 | 141,491 | +9% |

| Senior Employee | 109,935 | 107,026 | -3% |

This shift reflects a clear evolution: as AI initiatives mature, buying committees are moving upstream.

Recent reports indicate that companies are struggling to see a direct return from implementing artificial intelligence. However, consumption is increasingly driven by leaders who are shaping long-term business strategies, rather than focusing solely on near-term execution.

That means more VPs, directors, and execs are engaging with content that helps shape 2026.

Key Takeaways

Photo by Darran Shen on Unsplash

Directors Lead the Pack (+26%)

Directors are increasingly responsible for evaluating solutions and launching AI initiatives. Their surge suggests that AI has moved beyond curiosity and into the strategic planning phase.

C-Level Executives Show Growing Interest (+15%)

C-suites are consuming more AI content, especially thought leadership and ROI-focused material. AI is officially a boardroom conversation.

Managers (+9%) Are Gearing Up for Execution

With a solid increase, managers are actively preparing for AI implementation, searching for enablement content that helps operationalize strategy.

Practitioners See Slight Decline (-3%)

Interest from ICs and senior employees may be leveling off, possibly due to earlier saturation or awaiting direction from leadership.

How This Impacts You

Job level is a strong proxy for intent. These shifts show:

- Buying committees are forming and becoming more senior.

- Content targeting must now support both enablement and executive strategy.

Format Trends: The Rise of Visual, Digestible Content

While eBooks remain a massive volume driver (661k AI-associated registrations in 2025 so far), they’re down 15% YoY. Just like we observed with the decline in registrations from individual contributors, this is notable because historically, this format has only ever increased.

The rising stars? Formats that promise even quicker wins, deeper interaction, or strategic insight:

| Format | 2024 Registrations | 2025 Registrations | YOY Delta |

| eBook | 779,643 | 661,161 | -15% |

| Cheat Sheet | 149,173 | 265,507 | +78% |

| Guide | 10,058 | 43,534 | +333% |

| White Paper | 32,884 | 40,977 | +25% |

| Infographic | 4,169 | 31,783 | +662% |

Format Takeaways

Explosive Growth in Infographics (+662%) and Cheat Sheets (+78%)

Audiences are signaling a need for quick, accessible insights at the top of the funnel—formats that summarize complexity without demanding deep commitment.

Guides Have Surged 333%

Guides bridge early-stage awareness and deeper evaluation, suggesting that users are ready to go deeper. The format’s structured, strategic content offers a step-by-step logic that may be missing from eBooks and even White papers.

White Papers Maintain Momentum

While guides may be more popular, a 25% increase proves that decision-makers still value white papers as sources of technical depth and thought leadership when evaluating vendors or framing transformation strategies.

Decline in eBooks

What could a 15% drop in registrations be signaling: potential format fatigue? Oversaturation? Languishing title appeal? Regardless, long-form content must now deliver exclusive value to justify time investment.

How This Impacts You

Photo by Patrick Tomasso on Unsplash

NetLine’s historical research highlights that format choice aligns closely with funnel stage and intent. The 2025 trends suggest:

- An influx of early-stage buyers.

- Growing preference for high-velocity insights.

- Increasing non-technical and executive-level interest in AI topics.

It doesn’t always work so linearly, but pairing fast, tactical formats like cheat sheets and infographics with buying-stage assets like webinars and playbooks can be a great way to move prospects through the funnel.

In this case, demonstrating how your AI solutions and/or tactics will be instrumental in driving any prospect activity.

Industry Engagement Trends: Emerging Hotspots in AI Content

Industry-level AI content analysis offers additional nuance to the 2025 trends. Key verticals saw varied levels of growth in AI-related registrations:

| Industry | 2024 Registrations | 2025 Registrations | YOY Delta |

| Legal & Compliance | 22,379 | 29,169 | +30% |

| Education | 37,760 | 46,080 | +22% |

| Financial Services | 106,739 | 121,131 | +13% |

| Healthcare | 52,834 | 64,276 | +22% |

| High Tech | 139,493 | 140,277 | +1% |

Key Takeaways

Regulated industries are catching up—and want trusted guidance. Vertical-specific campaigns should reflect industry language, compliance concerns, and business models.

Legal, Education, and Healthcare Are Surging

Industries traditionally slower to adopt new tech are now embracing AI rapidly—especially in contexts of risk management, automation, and personalization. (Here’s to hoping that our peers in the healthcare space are able to leverage AI for all the good it could possibly offer.)

Financial Services Maintains Strong Momentum

Already a leader in AI experimentation, this vertical continues to rise, particularly in areas like fraud prevention, forecasting, and automated customer service.

High Tech Levels Off

With just +1% YOY growth, High Tech appears saturated in terms of top-of-funnel AI interest. This cohort may be deeper in implementation and ROI realization.

Smaller Totals, Big Interest

Certain sectors are coming online in a big way as 2025 winds down. Among job areas with a strong 2024 baseline (≥5,000 registrations), here’s who’s on the rise:

- Finance/Accounting: +32.2%

- Manufacturing/Operations: +27.6%

- Sales: +24.1%

- Customer Support: +22.6%

- Logistics/Transportation: +20.0%

These gains mirror broader market behaviors: strategic budget holders and ops leads are planning for efficiency, automation, and scalable growth.

AI Content Isn’t Slowing Down

Content uploads spiked dramatically in Q4.

For example, AI content uploads spiked in October 2025, rising 317% from October 2024

The sharp rise in upload volume suggests that more marketers are actively developing and distributing AI-focused content to meet the demands of a business audience hungry for implementation strategies and practical guidance.

It also points to a seemingly obvious fact: AI is no longer just a trending topic, but a standard category.

And the titles that converted best? Forward-looking, application-driven themes like:

- “Business Writing with AI”

- “Prompt Engineering Fundamentals”

- “Mastering AI Agents”

The common thread here is that these assets blend 2026 readiness with tangible value.

What Titles Reveal About Buyer Intent

One of the more telling developments in 2025 is the evolution of AI-related asset titles.

Compared to previous years (when titles often emphasized general awareness or curiosity), this year’s top performers reflect a marked shift toward specificity and application.

Terms like “Prompt Engineering,” “AI Agents,” and “Copilot” speak to how buyers are thinking: not about what AI is, but how to use it.

This reflects a rising bar for content utility. B2B professionals aren’t satisfied with generic guidance. These professionals are looking for resources that help them implement, experiment, and lead with AI in practical, business-relevant ways.

It’s no different than the advice Andy Crestodina shared in a webinar earlier this year with NetLine. Using a title like “AI for RevOps Managers in Fintech” isn’t too niche. Granularity breaks through. “Buyers don’t want to read about the future of AI,” he said. “They want to know what AI means for next Tuesday.”

For marketers, this shift underscores the importance of moving beyond trend pieces and providing assets rooted in enablement. Titles that center on skills, frameworks, and future-state readiness are resonating.

And when it comes to cutting through noise in an AI-saturated market, specificity wins.

Final Thoughts

AI content consumption across NetLine in 2025 tells a clear story: buyers aren’t just casually browsing—they’re actively seeking tactical, applied insights to drive their next steps.

With more than 1.26 million AI-related registrations and a sharp rise in focused, utility-driven content uploads, it’s clear that the B2B audience is hungry for enablement—not fluff.

The implication for marketers is equally clear: stay active, stay targeted, and stay practical. Whether it’s through smarter titles, advanced frameworks, or deeper delivery formats, your content should mirror the maturity of your audience’s AI curiosity.

By leading with clarity and substance, you won’t just earn their attention; you’ll shape their roadmap.